How to Improve Your Credit Score in Canada: Ultimate 2025 Guide

Having a low credit score can make your life a lot more difficult, It's much harder to qualify for loans you need, and you will be stuck with predatory rates for mortgages and credit cards. If your credit score is low then you’ll want to start recovering it as soon as you can, it’s a slow process but with these tips, you can get that process started and rebuild your credit score in Canada.

Covered in this Article

- What is Credit?

- Factors that Influence Credit Score

- Credit Reports

- Pay off Current Debts

- Credit Utilization

- Take on Good Debt and Pay Bills on Time

- Why do we Need Debt in Life?

- How does Debt Help Build Credit?

- Use Credit Cards

- Smart Finance Practices

What is a Credit Score?

If you already have a decent idea of what credit score is, you can scroll past this, but we thought it would be a good idea to start with the basics. Credit is essentially you paying for things with someone else’s money (usually the bank) which you’re obligated to pay back at a later date. To make the exchange worthwhile for the lender (the entity lending you the money), they charge interest which is a percentage rate of the total amount you borrowed that you’ll have to pay back. This is how banks make money!

Simply put, credit cards, loans, and mortgages are all basically the same concept except with different names depending on their usage.

The Main Factors that Influence Credit Scores

Several different factors affect your credit score according to the FICO formula (used to calculate 90% of credit scores in Canada). We'll go through them one by one.

Payment History: Payment history has the biggest impact on your credit score (roughly 35%). It’s highly encouraged that you never miss a payment date or it could severely lower your credit score. On the flip side, making all your payments on time is also the best possible way to consistently improve your credit.

The Amount you Currently Owe: This shows the lender how reliable you’re going to be when it comes to your ability to pay off the loan. Roughly 30%. This is your debt-to-income ratio.

Credit History Length: this is the amount of time you’ve had a credit history. The longer the better, which is why we recommend you start building a credit history as soon as possible. Credit history length is roughly 15% of your credit score calculation.

New Credit: This means how many new accounts you have, and how many loans/accounts you have applied for recently. This is roughly 10%.

Types of Credit: The FICO formula will take a look at the different types of credit you own such as credit cards, loans, mortgages, etc.

How to Rebuild Your Credit Score in Canada

Now that we've talked about what credit score is and how it's calculated, we can move on to the steps you should take to increase yours.

1. Get a Credit Report and Constantly Monitor it

Before you rebuild your credit score in Canada it’s good to know exactly where you're starting from. Your credit score is calculated via all of the different factors of your credit report, so that's where you want to start. Click here to access the government of Canada's guide on getting your credit report.

Equifax Credit Report and Score

What is Your Credit Report?

If you don’t know, your credit report is a piece of paper that’s a summary of your financial history and standing. It includes all of the basic information you might expect such as your name and address, but more importantly, it also shows your credit history, public records, and credit inquiries.

Your credit report will give you a detailed list of all of your unpaid debts, active lines of credit, and missed payments, every time credit passes through your hands in the last 10 years it will be written out which is useful information to have.

You can also check for errors, they’re more common than you might expect and can contribute negatively to your credit score. Finding and fixing an error may be a nice head start on the recovery process.

How do you get a Credit Report?

Getting your credit report is quite simple. As a Canadian you’re entitled to a free credit report every 6 months. Primarily you can get it via either TransUnion or Equifax Canada. and while you're in the process of rebuilding you want to be checking it as much as you can. Getting a credit report doesn’t affect your credit but it gives you access to all the information and lets you see what effects your rebuilding efforts are having.

How to Read your Credit Report

Like all other financial documents, credit reports are filled with financial jargon that can be tough to understand. To help, simply go to canada.ca. The website has a helpful list of the important numbers on your credit report and what they mean.

Common Errors on a Credit Report

Here are some of the most common errors to watch out for on a credit report and what you can do to fix them.

Personal Info: The first error to watch for and probably the easiest to spot is errors with your personal information such as incorrect or outdated addresses, typos in your name, and missing phone numbers.

These are not critical problems that will impact your credit score, but they are issues nonetheless and may cause some confusion and extra hassle later when you’re trying to apply for a loan, so it’s best to get them sorted sooner rather than later.

Accounts Misinformation: Now we’re starting to get into the errors that can cause an impact. “Accounts” is a general financial term that here refers to all of your open loans or lines of credit. Several errors can show up here such as closed accounts still marked as open, open accounts incorrectly marked as closed, payments made on time that have been registered as late, or sometimes whole accounts you never actually made.

Errors like this can be caused by simple human error or a mistake in the algorithm, in extreme cases your account could be confused with someone else's who shares the same name as you. Regardless of how they happen, they can have a severe impact and should be your top priority to fix.

Balance Misinformation: In a similar vein the balances of your accounts and credit cards being incorrectly marked can also negatively affect your credit score as it will mess up both your DTI (Debt to Income) and credit utilization ratios which both contribute to your credit score.

Again, these can mostly be created by human error, mostly typos, but a small mistake can have a big impact on your financial health so we recommend fixing them as soon as possible.

2. Pay off Current Debts

Around 35% of your credit score is calculated via payment history, which means your credit score doesn’t like late payments. Any late payments you’ve made will leave their mark for the next 10 years but you can start countering them making all future payments on time. Automating your payments is highly recommended. You need to pay off your current missed payments before you can fix your credit.

If you can’t afford to meet your payments or make up for the missed payments, we recommend contacting your creditor and negotiating a deal that fits your budget with lower payments at a longer length. If your creditor isn’t willing to negotiate a better rate for you, we suggest you seek a non-profit credit specialist to work with you on a plan to catch up on your missing payments.

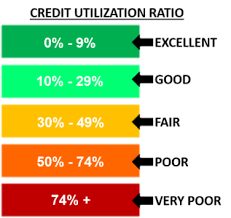

Credit Utilization

Credit utilization is an important factor to keep in mind when it comes to rebuilding your credit score in Canada. Credit utilization is the amount of debt you have compared to the total amount of credit you’re allowed to have.

Depending on where you look It’s usually recommended to keep your credit utilization rate below 30%. So for example, if you have a limit of $10,000, it’s recommended that you shouldn’t be borrowing more than $3,000.

Source: Loanry.com

A high credit utilization rate can hurt your credit score because it’s a sign that you might be experiencing high financial difficulty and struggling to make your payments, or have too many outstanding loans. So, before you rebuild your credit score in Canada, we recommend you pay off your debts and lower your credit utilization.

3. Take on Good Debt and Pay Bills on Time

Understandably, people avoid being in debt at all costs. This sounds like a perfectly reasonable thing to do because typically if you hear someone is in debt it means they have a poor financial situation. Well, the truth is, finances are silly sometimes and you need to take debt to build your credit score in Canada. You need to pay interest to pay less interest. We’ll explain what we mean by that.

Source: Debt.org

Credit is a strange thing because contrary to what you might think having no debt isn’t actually desirable when it comes to your credit score, though having too much isn’t what you want either, you need to strike a fine line with your credit utilization ratio.

Why Do We Need Debt?

Unless you’ve got millions of dollars lying around, the fact is there are just some things in life where it doesn’t make practical sense to save up the money first and then buy it in one single payment. Take a car for example. Like most people, you probably can’t afford to pay $40,000 upfront for a brand-new vehicle.

Instead, you’d pay $8,000 up front and the remaining $32,000 in monthly increments of $444 for 72 months. This doesn’t include the additional interest you’d have to pay, but you could see why taking debt is a requirement.

How Does Debt Help?

When a lender is considering giving you a loan, they’ll look at your credit score which is a risk assessment on you. They want to be sure that you’re going to pay such a significant amount of money back promptly. They’ll check your debt history and that will show them that you do indeed make payments on time and are at low risk of not paying back the loan. It essentially shows them that you’re a reliable borrower.

This is why having debt is important, you need a debt history to prove that you are a reliable person to lend such a large amount of money to. If you have no debt history, the lender will be wary because “nothing tells them nothing” and by default, they would assume the worst.

4. Start Using a Credit Card Daily

If you have no credit history it’s time to start building one and this is done by using a credit card. A credit card is basically a small loan for a small purchase. To rebuild your credit score in Canada, simply buy things on your credit card and pay it back on or before the required date. This is perfect for things you’re going to buy anyway that you might currently use your debit card for; things like groceries, gas, and rent.

Credits: Avery Evans

Constantly using and paying off a credit card looks good on paper as you're making lots of credit repayments on time and it keeps your credit utilization above zero. This process will take time, years even, but with some dedication and good methods, you can rebuild your credit score.

Get a Secured Credit Card

A secured credit card is something you can use to help rebuild your credit score in Canada. A Secured credit card is a card which is backed by a security deposit that you would provide to the lender, where in the case that you fail to make payments, the lender can claim your security deposit instead. It essentially means if you’re at risk of missing a payment, your security deposit will handle it. It’s insurance!

Source: GreedyRates.ca

A secured credit card is a great option because it helps prove to a future lender that you’re a responsible borrower! Usually, you’d want to get an unsecured credit card instead of a secured one when you have really bad credit and secured credit cards are out of reach, or you have no credit at all because you’re young or new to the country.

5. Adopt Smart Finance Practices

It’s crucial to adopt smart finance habits to make sure you never experience a bad credit score again. Here are some tips to improve your finances for the rest of your life!

Start a Budget

This is the most important finance tip we can suggest. A budget is an extraordinarily useful tool you can use even if you aren’t saving up for a large purchase. It can help you manage your money, see exactly where your money is going, and show you ways you can save money you’re spending unnecessarily. Also, maintaining a record of all your income and expenses might come in handy during tax season

Prepare for Taxes Early

There is absolutely no reason to wait until the last minute to prepare your tax documents. You don’t need to send them out right away, but it’s always a bad idea to spend the last week of April stressing out trying to find all the right paperwork.

Set up an Emergency Fund

There are other uses for some extra cash and an emergency fund is a great investment if you don’t have one already. If you ever are at a point where you’re about to miss a payment or something in your life goes horribly wrong, an emergency fund can come in very handy.

That’s about all we’ve got to rebuild your credit score in Canada. Remember that it’s a lengthy process but one that will make your life much less stressful, and even less expensive.

We'll help you find a fair-priced car loan in Southern Ontario no matter what your credit score is. Click here to get pre-approved online with us at Car Nation Canada, or fill in the form below if you have any questions or inquiries about rebuilding your credit score in Ontario.